PricewaterhouseCoopers’ (PwC) team of hotel specialists provided an overview of how the hotel industry is expected to develop over the coming years, on Thursday (July 5) at 54 on Bath in Johannesburg.

The report, titled ‘PwC Hotels outlook: 2018-2022: South Africa – Nigeria – Mauritius – Kenya – Tanzania’, details the key trends observed and the challenges facing the sector, as well as considering future prospects.

In South Africa, overall revenue from hotel room accommodation rose by 4.6% to R16.6 billion (€1 billion) in 2017. Looking further back to 2012, revenue sat at R10.7 billion (€674 million).

Pietro Calicchio, PwC Southern Africa Hospitality Industry Leader, says hotel revenue is looking positive, considering hotels are suffering the same stress as locals, with the increase of petrol, water, rates and taxes.

PwC anticipates that hotel room revenue will grow by 3.3% in 2018 to R17.2 billion (€1.1 billion), with a compound annual growth rate of 5.6% over the forecast period.

Over the next five years, 2 900 hotel rooms are expected to be added, with occupancy rates expected to continue to grow over the forecast period and to reach 62.5% in 2022.

Room rates and guest nights were up in 2017, with new hotels coming online in 2017, especially in Cape Town, and with this, South Africa still managed to maintain its occupancy, as it stayed more or less the same, according to Calicchio.

The number of available rooms rose 1.3% in 2017, the largest increase since 2011. Openings in 2017 included the Radisson Blu Hotel & Residences and Radisson Red V&A Waterfront and the Sun International Meropa in Polokwane, each of which is a four-star hotel, and the Stayeasy Cape Town City Bowl, a three-star hotel.

PwC expects an even larger increase in available rooms in 2018, accounting for a 1.8% gain, with Menlyn Time Square in Pretoria entering the market and the refurbished Grandwest in Goodwood and Carnival City Resort in Brakpan reopening in 2018. The market will also benefit from the full-year impact of the 2017 openings.

Scheduled openings for 2019-2021 include the Radisson Blu Oceans Umhlanga in Durban, the Marriott Johannesburg Melrose Arch, the Marriott Executive Apartments in Johannesburg, two Hilton Garden Inns – one in Durban and another in Malelane, and the Novotel Sandton Summit. Each of these is a four-star hotel.

PwC expects the overall number of available rooms to increase at a 0.9% compound annual rate to 64 900 in 2022, from 62 000 in 2017.

Guest nights edged up 0.7% in 2017, not matching the 3.0% increase in 2016 as growth in international tourism slowed. PwC expects guest nights to be steady in 2018, followed by a pick-up in subsequent years due to a stronger economy and faster growth in foreign and domestic tourism. For the forecast period as a whole, PwC looks for the number of guest nights to increase at a 1.4% compound annual rate to 14.8 million in 2022 from 13.8 million in 2017.

With guest nights projected to grow a bit faster than room supply, the occupancy rate for hotels will edge up to a projected 62.5% in 2022 from 61.0% in 2017.

The Average Daily Rate (ADR) rose 3.9% in 2017, the smallest increase since the 9.4% decline in 2011.

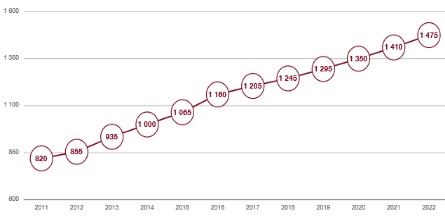

Contributing to this was the dip in occupancy rates, a stronger rand, and a slower domestic inflation. With occupancy rates expected to drop, PwC projects ADR to grow 3.3% in 2018. PwC then expects modest growth in occupancy rates and continued moderate inflation to result in ADR growth remaining relatively modest, with a projected 4.1% compound annual increase. The average rate will rise from R1 205 (€76) in 2017 to a projected R1 475 (€93) in 2022.

Average room rates 2011-2022. Sources: PricewaterhouseCoopers LLP, Wilkofsky Gruien Associates.

Three-star hotels accounted for 36% of all available hotel rooms in SA and 31% of total room revenue.

Guest nights for three-star hotels were up 1.9% and, combined with the 3.2% increase in the ADR, room revenue grew 5.1%. Room revenue in three-star hotels will expand at a projected 4.3% compound annual rate to R6.4 billion (€404 million) in 2022, from R5.2 billion (€328 million) in 2017.