If South Africa plans to meet its tourism growth targets, it must address visa issues that have plagued the Indian and Chinese markets.

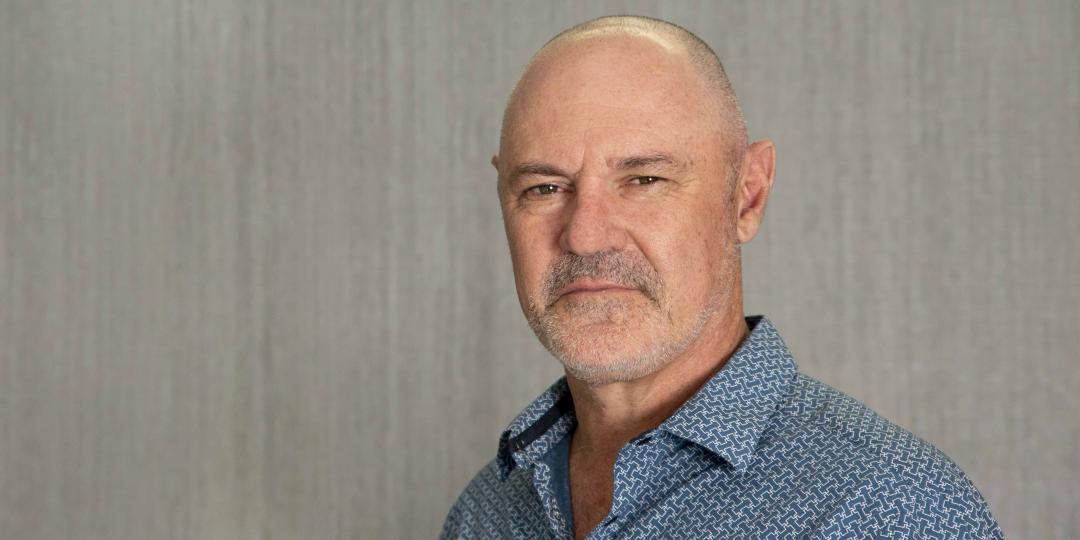

David Frost, CEO of SATSA said: “India and China have the greatest potential for growth. We’re not going to grow North America and Europe at double the numbers. In India and China, we can actually get some good growth. We don’t want mass tourism, but we should be at least doubling our numbers.”

However, even before the pandemic, the numbers of tourists from these markets were receding. This is something Frost attributes to the visa regime, which is complicated and beset by delays.

Conversely, Australia has seen tremendous growth, purely because the government has committed to making tourism a priority, making visas easier to get and working with the industry to grow the sector.

India

India is one of the world’s fastest-growing outbound tourism markets. Data from McKinsey&Co suggests that the market could go from 13 million outbound trips recorded in 2022 to 80 million in 2040.

The same McKinsey report states, “Complicated visa application processes, or long waiting periods, can influence decisions around vacation destinations. Leisure travellers can be swayed by how difficult or easy it may be to obtain a visa.” The report uses the example of Azerbaijan simplifying its visa processes in 2017, with a resultant five-fold increase in Indian tourist arrivals by 2019.

Indian visa arrivals in South Africa showed excellent growth between 2008 and 2012, with numbers peaking at just over 112 000 arrivals. However, in 2014, there was a sharp drop- linked to the implementation of unabridged birth certificate rules by Home Affairs in the same year. Despite some improvements since then, by 2019, only 95 621 arrivals to South Africa were recorded.

In the same time, Indian arrivals to Australia more than doubled. With 176 900 arrivals in 2013, they did have a head start on the South African market, however by 2019, the number of Indian arrivals reached 399 000, more than four times the number of Indian arrivals in South Africa.

China

Prior to the pandemic, the Chinese outbound market was the highest spending tourist market globally. And while the country does not feature in South Africa’s top ten key source markets, it presents exceptional opportunities for growth, despite being slow to recover.

The data for South Africa follows a very similar pattern to the Indian market, with arrivals showing 275% growth between 2008 and the peak reached in 2013. Arrivals then dropped from over 151 000 in 2013, to just under 83 000 the following year. There is a significant increase again in 2016 followed by steady decline until 2019, when 93 000 arrivals were recorded.

A comparison with Australia, reveals that Chinese tourist arrival numbers more than doubled between 2013 and 2019.

A document of ‘Game Changer’ interventions Australia put forward to grow tourism between 2015 and 2020 included a focus on simplifying the visa regime. Among the interventions, Australia looked at a 24-hour turn-around time for all visa applications from key markets.

E-visas were introduced for the Chinese market in 2022, but Frost says they are poorly suited to the market as they only allow for individual applications, when Chinese travellers prefer group travel.

There have been significant issues with the e-visa system. In response in the National Council of Provinces in 2023, the Department of Home Affairs indicated that of the total number of e-visa applications (not just China), almost 60% were rejected because the travel date had already passed. The Department had also earlier indicated that only 3.2% of the total number of applications received resulted in a visa being granted.

“We don’t have enough officials,” Frost said. He’s done the numbers and with four visa officials based in Beijing processing 100 000 visa requests annually, working for seven hours a day, for 21.3 days per month, they would each need to process a visa every 4.5 minutes.

Frost says one of the other major stumbling blocks in the visa process is that the form must be completed in English.

“Imagine you as a South African are travelling to Bulgaria but in order to go, you have to fill out the form in Bulgarian. This is the equivalent.”

Tourism Minister Patricia de Lille is on record as saying she wants a visa waiver for both the Indian and Chinese markets. She also indicated during her visit to China at the end of 2023, that plans were in place to translate the e-visa website and application for the Chinese market.

The Russian example

Russia provides a strong example of what could happen if visa regimes were relaxed. In March 2017, then President Jacob Zuma signed a new visa protocol with Russia, scrapping the need for visas for tourists staying in the country for up to 90 days.

There was an almost immediate increase in visitors, with numbers of Russian travellers jumping 51% between 2016 and 2017, according to Wesgro’s Russian market insights.

The market has also recovered, and exceeded pre-COVID levels.