The month of October 2016 will not go down as one that South Africans will remember fondly or be very proud of.

Perhaps the Boks’ final Rugby Championship game against the All Blacks was a precursor of things to come on the economic, political and social front. Things looked not too bad but then deteriorated rapidly – to end up a 57-15 (eight tries to nil) disaster.

Well, it seemed that way at the start of the month, with things seeming to have finally calmed down a tad, with some measure of (albeit nervous) stability returning to the fold.

But that was just the calm before the storm, as the rumblings over the past few months erupted all together:

Firstly, Finance Minister Pravin Gordhan’s months-long tussle with the Hawks, Sars (and President Jacob Zuma) came to a head and suddenly, with the announcement by the National Prosecuting Authority (NPA) that Gordhan would be charged for fraud - followed by the October 31 announcement that the fraud charges would be dropped.

The fact that the NPA was making a beeline for a single, small and legal act by Gordhan, but have yet to act on the court order to proceed with the 763 corruption charges against Zuma pretty much sums up the situation - this is a political ploy to get rid of a man that is bent on preventing the state coffers being ransacked.

The rand of course reacted immediately, jumping 40 cents in a matter of minutes.

The volatility was back with a vengeance and so was the uncertainty.

But if Zuma thought he had played his trump card, he clearly hadn’t seen Gordhan’s hand, as Gordhan hit back with a bombshell court application that revealed numerous suspicious transactions by the Guptas totalling almost R7 billion.

And the apparent solidarity behind Zuma within the ANC upper hierarchy started showing some sizeable cracks, as more political heavyweights threw their support behind Gordhan – including the deputy president.

Needless to say, this game is not over yet, with the November 2 court hearing likely being the first of many.

And then the social unrest that had been simmering erupted, as dissatisfied and militant university students launched ongoing and increasingly violent #FeeMustFall protests, in the process showing scant regard for university property, peaceful students who merely want to study, or the rule of law.

And then, of course, we had the ongoing Zuptagate state capture circus continuing to unfold, with the fearless Public Protector Thuli Madonsela being replaced but not before she had completed her State Capture report, which, of course, the President has blocked from being publicly released by applying to court and a seemingly toothless replacement, Busisiwe Mkhwebane, stating she would not oppose the application, prompting other political parties to oppose and apply for its release.

What a month!

All this has not done anything to boost investor confidence nor has it done anything to allay the fear of a ratings downgrade at year-end with all its implications on the economy.

And of course, the question on everyone’s lips is – what is going to happen to the rand if this happens? Or if that happens?

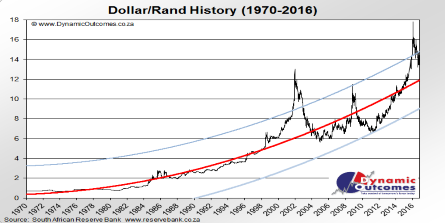

As you can see from the Rand’s history chart, it has swung wildly either side of fair value over the years, with 2001 and 2016 being notable in this regard.

By now it should be clear that markets are not driven by fundamental or events – else the rand would be well on its way to R20 by now!

No, the rand’s zigzag movements are caused by changes of sentiment in varying degrees, from small swings to huge spikes at extremes of sentiment, and it is by analysing these patterns using the Elliott Wave Principle that we are able to get some fix on where the market is likely headed next.

To illustrate, here is a forecast on May 6, 2016 when the market had just hit 14.15 before rising strongly.

While many say this is the start of the next move up to 18.00 and beyond, what our Elliott Wave analysis foresaw was a move up above 15.50 before falling sharply to below 13.50 – which is exactly what happened. This was done without knowing what political or social events or fundamental news was going to hit the market.

The above shows the benefit of sticking to an objective view that is based on analytical principles rather than floundering under all that is going on around us.