As we step into 2025, South Africa’s tourism recovery remains uneven. While overall inbound tourism sits at just under 82% of 2019 levels, the distribution of visitors is highly concentrated in just two key regions: Cape Town and the Kruger National Park. Meanwhile other provinces – despite offering exceptional tourism experiences –continue to struggle. If we are to surpass pre-pandemic numbers and drive sustainable tourism growth, we must ask: How do we expand geographical spread and ensure a more balanced recovery?

Looking at overseas arrivals between 2000 and 2017, we see steady growth – from 1 394 395 arrivals in 2000 to 2 725 855 in 2017. Since then, international arrivals have declined followed by the pandemic years. Now we measure our recovery against 2019, the last pre-pandemic year, although it was not our peak – 2017 was.

The state of recovery

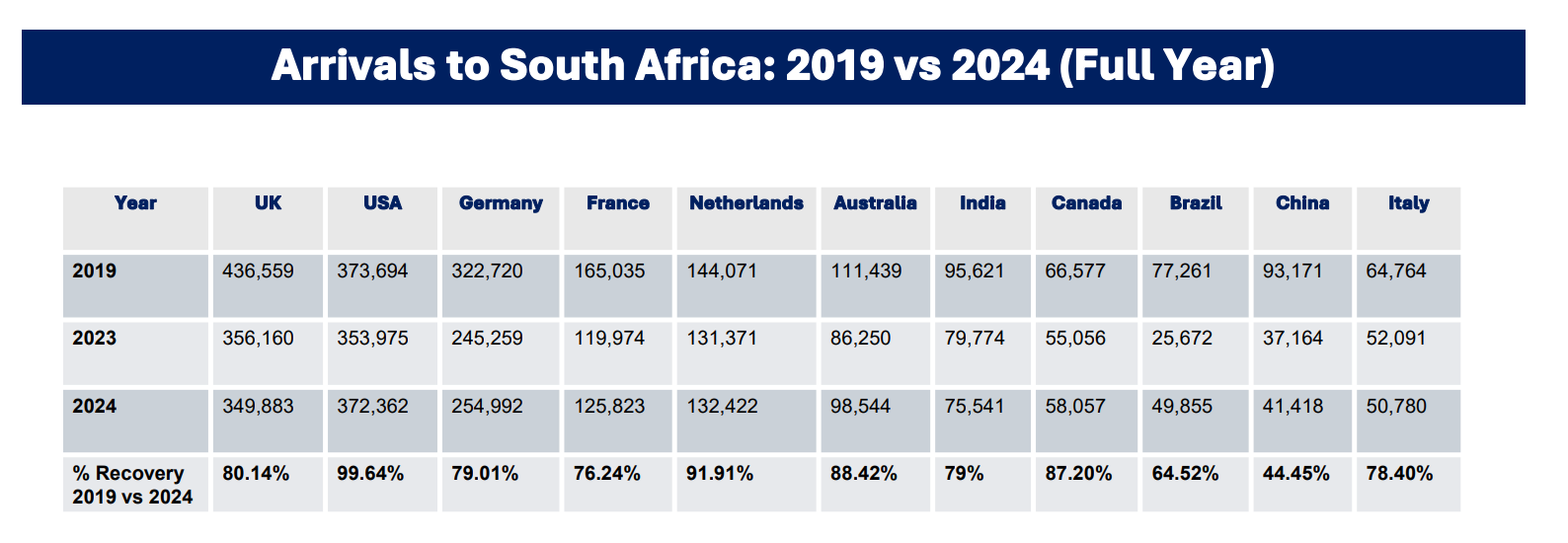

Comparing 2019 to 2024, we are currently at just under 82% recovery. Some source markets have rebounded faster than others – such as the US (99.64%) and the Netherlands (91.91%) – while key European markets, including the UK (80.14%), Germany (79%) and France (76.24%) lag behind. This is concerning as these markets traditionally contribute a good-value, mid-market segment that drives intrepid travel. Three of our top four source markets for South Africa are at 80% and under.

While the national recovery rate sits at 81.79%, certain regions have surged ahead. The greater Cape Town area, hailed as a top global destination, has outperformed expectations thanks to a coordinated effort by stakeholders. Similarly, luxury lodges in the Kruger National Park have exceeded 100% recovery.

While the national recovery rate sits at 81.79%, certain regions have surged ahead. The greater Cape Town area, hailed as a top global destination, has outperformed expectations thanks to a coordinated effort by stakeholders. Similarly, luxury lodges in the Kruger National Park have exceeded 100% recovery.

But, if Cape Town and Kruger are thriving, what does this mean for the rest of the country?

A tourism imbalance

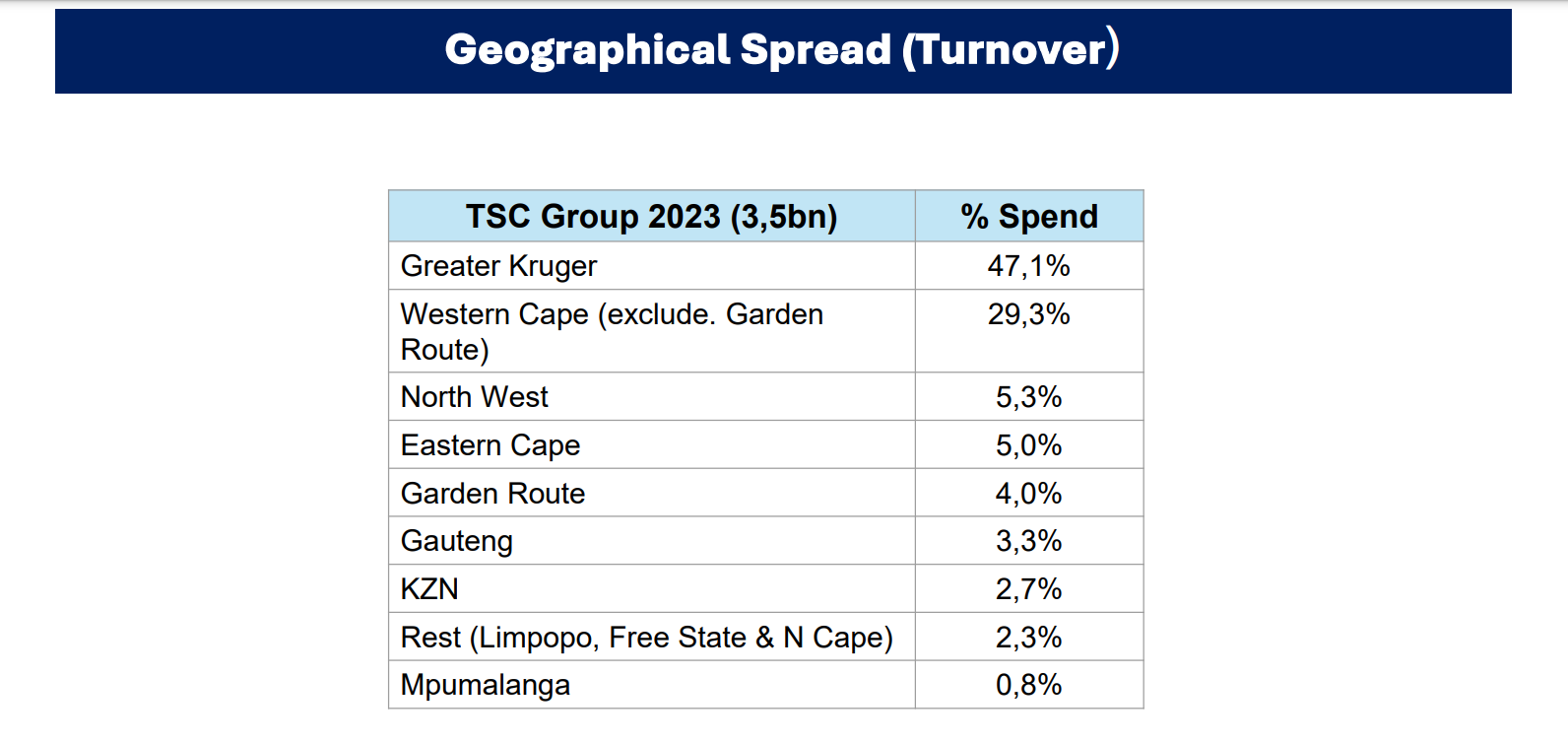

To gain deeper insight, we turn to the data. The Southern Africa Tourism Services Association (SATSA) has been engaging with leading destination management company (DMC) groups to assess turnover and bed nights per province as a barometer of geographical spread. The findings are stark.

Travel Smart Crew’s 2023 data shows that, of their R3.5 billion turnover:

- 76.4% was spent in the Western Cape (excluding the Garden Route) and the Kruger National Park region

- The Eastern Cape accounted for just 5%

- The Garden Route’s share was 4%

- KwaZulu-Natal accounted for a mere 2.7%

- Mpumalanga (outside Kruger National Park) sits at a shocking 0.8%

This pattern is corroborated by Tourvest Destination Management with a similar concentration of tourism spend in the Western Cape and greater Kruger National Park.

This pattern is corroborated by Tourvest Destination Management with a similar concentration of tourism spend in the Western Cape and greater Kruger National Park.

Room-night data from New Frontiers Tours shows:

- Cape Town and Kruger accounted for 60% of total room nights in 2019 – rising to 69% in 2024

- KwaZulu-Natal’s share fell from 8% to 5%

- The Eastern Cape declined from 6% to 5%

- Mpumalanga remained stagnant at 2%

Interestingly, data from Royal African Discoveries, which has a strong Indian and Southeast Asian market, shows a slightly better geographical spread. Western Cape (excluding the Garden Route) and Kruger National Park lodges accounted for 61% of turnover. However, in terms of bed nights, the Garden Route accounts for 15%, North West 12% and Gauteng 8.5%.

Lessons from competitors

How does our overall recovery compare to our East African competitors? In 2023, Kenya recovered to 105% of its 2019 figures, reaching 134% in 2024. Tanzania saw a similar pattern with recovery at 119% in 2023 and 142% in 2024.

The reality is clear: We are stagnating at around 82% of our 2019 arrivals and our geographical spread is becoming increasingly skewed. Does this concern us? It should.

What needs to change?

Everything we have done collectively – from a public and private-sector perspective – has led us here. If we want to shift this picture, we must ask: What can we do differently?

A properly structured partnership between the Tourism Business Council of South Africa and its constituent associations, along with South African Tourism, is a fundamental first step.

Many challenges lie beyond the immediate control of SATSA members: safety and security concerns, infrastructure issues and domestic flight constraints, to name a few. However, the process of selling a holiday to South Africa is a private-sector transaction – be it business-to-business or business-to-consumer.

Long-haul visitors will naturally gravitate towards iconic destinations like Cape Town, Kruger and Victoria Falls. We commend Cape Town’s success and the efforts behind its positioning as a world-class destination. But what happens when peak season hits and availability in these destinations becomes scarce? This constrains growth and limits our ability to surpass the 2.6-million arrival mark annually.

To truly drive growth, we need to:

- Showcase exceptional destinations beyond Cape Town and Kruger – this is not a short-term fix but a long-term investment – starting now!

- Better data is also essential. South Africa has high repeater rates – visitors appreciate our affordability, service excellence and world-class tourism offerings. Are we leveraging this to drive geographical spread?

- Strengthen industry collaboration – our ability to find solutions lies in unified action.

One key lesson from the pandemic is that, when industry leaders collaborate, solutions emerge. Now we must apply the same energy to driving a more equitable tourism recovery and, indeed, to facilitating growth going forward.

Join the conversation

SATSA is taking the lead in tackling these issues head-on. To advance this conversation, we invite industry stakeholders to join us for a critical discussion on March 13 from 15h30 to 17h00. We will focus on geographical spread and tourism prosperity in South Africa. Key industry leaders will share their insights on how we can achieve this.

The inimitable Natalia Rosa will facilitate a panel discussion with the following industry leaders:

- Helen Bolton, Head of Sales, New Frontiers Tours

- Illana Clayton, CEO, Travel Smart Crew

- Suzanne Benadie, Sales and Marketing Director, Sense of Africa

- Johan Groenewald, MD, Royal African Discoveries

- Monika Iuel, Chief Tourism Officer, Wesgro

This webinar isn’t just for SATSA members; we’re throwing the doors wide open! If you’re keen to be part of this crucial conversation, come on in. You can register for the webinar here. For those who can't make it, we will be making the recording available on our website and on other association platforms.

We also encourage other DMCs to share their geographical spread data with us – please send this to david@satsa.co.za.