Private-sector leaders are urging government to double down on efforts to capitalise South Africa’s international tourism potential in light of arrivals “underperformance” in 2024.

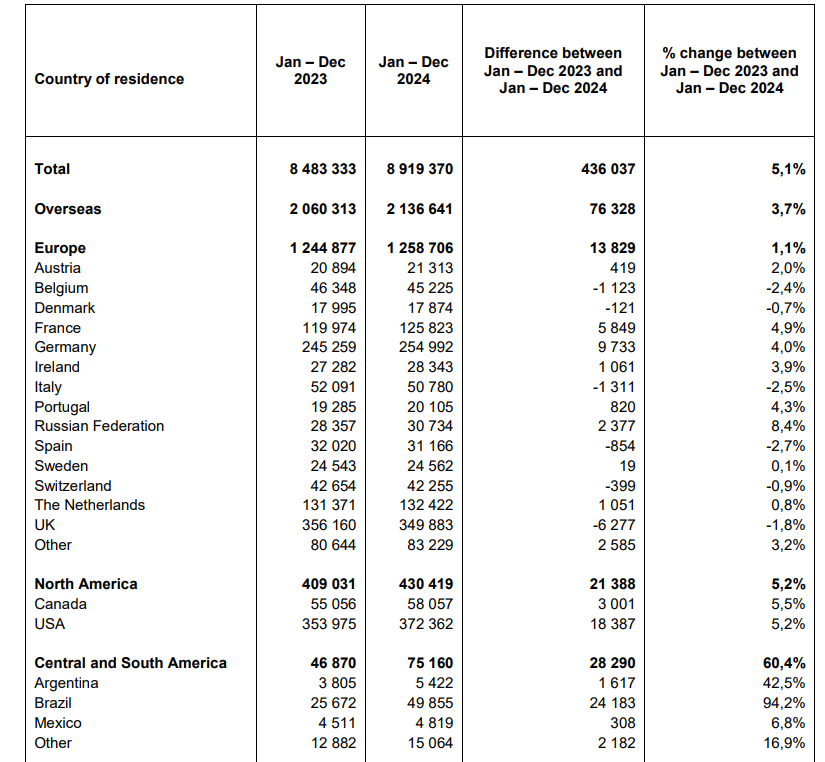

According to Statistics South Africa’s latest International Tourism Report, the country recorded a 5.1% year-on-year increase in total arrivals to over 8.9 million – just 87% of the full-year 2019 figure of over 10.2 million. Overseas visitor arrivals grew by 3.7% to just over 2.1 million or 82% of 2019 levels.

In a statement on the figures, the Department of Tourism acknowledges that, while the year-on-year growth represents steady progress, “more consistent investment in air connectivity and global marketing is needed to remain competitive”.

David Frost, Chief Executive Officer of SATSA , agrees the country is lagging behind its regional competitors.

"South Africa is significantly underperforming against countries like Kenya and Tanzania, which have far exceeded their pre-COVID numbers. Systemic inefficiency, combined with air access challenges and infrastructure issues like recent fuel shortages at OR Tambo, continues to strangle our growth potential.”

European performance is cause for concern

Arrivals from Europe, South Africa’s largest source market region, increased marginally by 1.1% year-on-year to 1.258 million in 2024, equating to 81% of the pre-COVID high.

Frost is particularly concerned about the performance of top markets such as Germany (79% of 2019), France (76%) and the UK (80%). "This underperformance represents a serious decline in visitors who traditionally drove geographic prosperity and explored lesser-known regions."

Americas shine

The North American market recorded a 5.2% year-on-year increase to over 430 000 – a strong 98% recovery rate.

Frost says, while this is encouraging, it illustrates potential overdependence on that market.

“We’re overly dependent on a single market that primarily drives high-end tourism. We urgently need to tap into markets that can energise our mid-market offering.”

Cape Town and the high-end lodge sector have rebounded to well beyond pre-pandemic levels but recovery rates of 50-60% in regions such as the Garden Route, Eastern Cape, KwaZulu-Natal and Mpumalanga dampen the upswing, emphasises Frost.

“This mid-market once ensured a healthy geographic spread. Without it, overall growth remains one-sided and unsustainable.”

Arrivals from Central and South America surged by 60.4% year-on-year to over 75 100, continuing to benefit from direct LATAM and SAA flights from São Paulo.

Suzanne Benadie, Sales Director at Sense of Africa, South Africa, says the statistics accurately reflect the destination management company’s international business for the year.

“North America grew and, while some source markets in Europe continued to show post-2019 recovery, there are still key markets where the numbers are flat. We continue to build on our gains in the Brazil market, which has shown growth in FIT and group travel. The direct flight offerings have been very positive on the market,” says Benadie.

Moving forward

In its statement, the Department of Tourism prioritises initiatives aiming to expand airlift, implement targeted marketing campaigns, harness technology, enhance safety and security measures and grow sustainable and cultural tourism.

“Efforts are underway to restore key routes, increase airline partnerships and improve direct access to a variety of cities in South Africa,” the Department states, citing Cabinet’s approval of the country’s Route Development Marketing Strategy in December last year as a key development.

However, Benadie says lack of air access and the resultant high costs of air travel need urgent attention.

“Many tour operators have given us feedback that airlift costs are prohibitive for southern Africa and travellers are selecting other destinations globally where the long-haul fares are cheaper.”

Frost identifies South Africa’s visa system as the most urgent and easily fixed obstacle.

“The stark contrast between markets with streamlined access versus those with barriers tells its own story. The solution is obvious: fast-track a fully electronic visa system.”

The selection of 65 tour operators for the Trusted Tour Operator Scheme (TTOS) has been welcomed as a positive move attracting arrivals from the high-growth markets of China and India but Frost says questions remain about operators accessing the scheme.

“The TTOS is a step forward yet, according to our sources, not one accredited operator has received clear guidelines on how to implement it.”

He is calling for South African Tourism to foster enhanced transparency and dialogue regarding arrivals statistics.

“Shouldn’t our destination management organisations be driving this discussion, outlining where we stand, the strategy to regain lost ground and the tactical plan to push beyond pre-COVID levels?”

Tourism Minister Patrica de Lille has asserted her commitment to accelerating the sector’s growth.

“We are determined to continue with this momentum and push the numbers much higher so that we can grow our contribution to economic growth and job creation even further. South Africa remains attractive and accessible for all travellers to enjoy.”