Travellers are increasing their budgets for African safaris, booking their trips further in advance and showing growing interest in alternative destinations. This is according to comprehensive new research from Go2Africa harnessing data from over 100 000 enquiries between 2022 and 2024.

Go2Africa’s 2024 Annual African Safari Report notes that the average budget for a safari shifted from the US$5 500 to US$6 500 bracket in 2023 to between US$5 500 and US$7 500 in 2024. This aligned with higher demand for longer trips: Go2Africa found that enquiries for trips lasting less than one week dropped by 40% while enquiries for longer durations increased.

“The higher budgets reflect a combination of an increase in desire for premium experiences, longer trips and the annual rate increases for safari travel,” said Go2Africa MD Majia de Rijk-Uys.

Alternative destinations gain traction

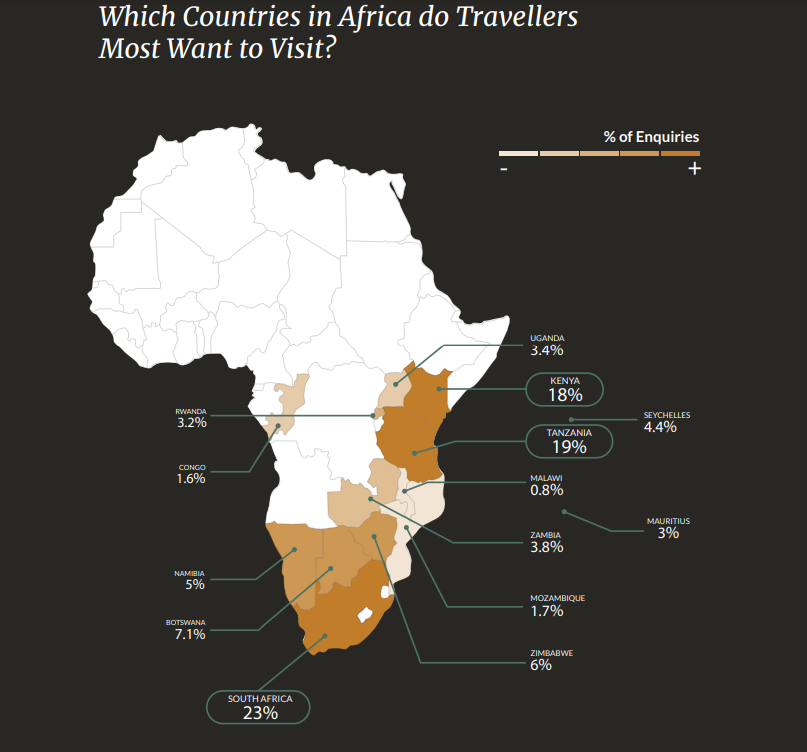

Traveller enquiries continue to be dominated by the “big three” destinations – South Africa, Tanzania and Kenya – which respectively accounted for 23%, 19% and 18% of enquiries.

Notably, enquiries for Indian Ocean island destinations, such as the Seychelles and Mauritius, grew by 71% – raising their cumulative share of overall enquiries from 4.4% to 7.4%. Interest in destinations such as Madagascar and Malawi more than doubled.

Go2Africa Safari Expert Justin Chapman said this was driven, in part, by traveller desire for unique and immersive travel experiences beyond the traditional safari.

“Travellers are definitely looking beyond traditional itineraries and seeking transformational experiences. This is driving interest in hidden gems as extensions to more classic routings. With so many popular beach destinations highly commercialised, being able to target more of the hidden gems that have a meaningful positive impact for surrounding communities is increasingly appealing.”

Chapman pointed to destinations such as Zambia’s Kafue National Park, Zimbabwe’s Matusadona National Park and Tanzania’s Ruaha National Park as increasingly popular choices for extensions.

Impact of widened peak season

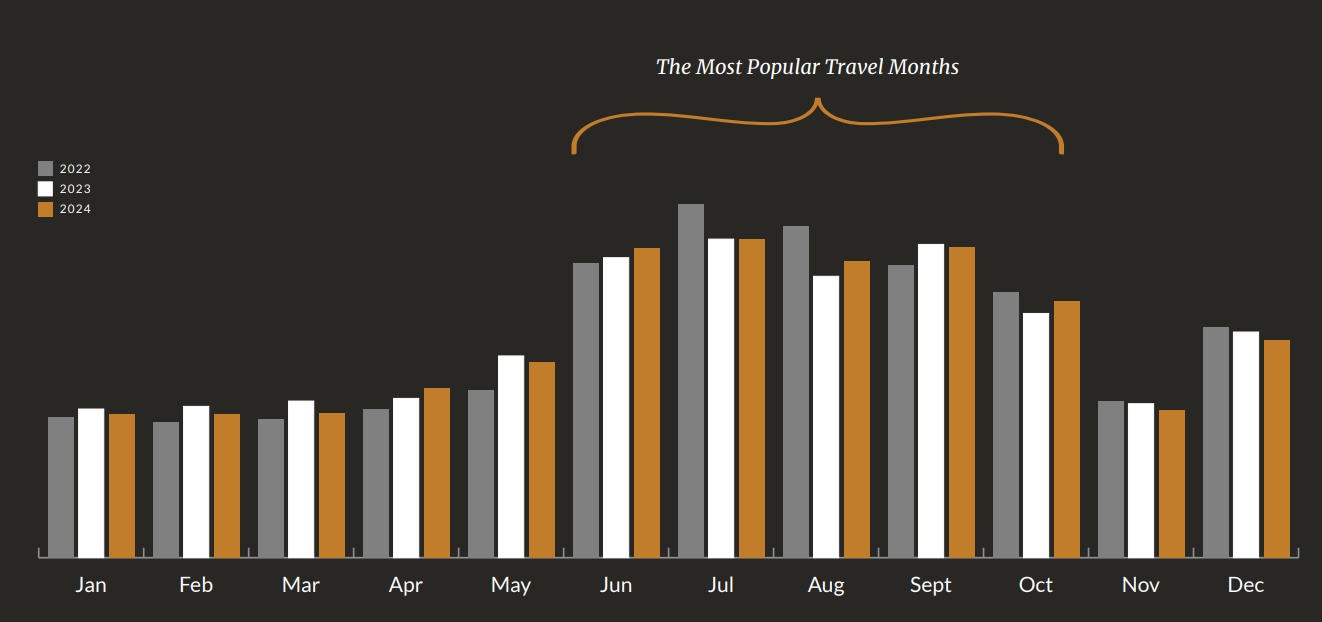

July remained the most in-demand month for travel, aligning with the “peak” of the Great Migration and prime wildlife viewing conditions across the region, but Go2Africa noted increased interest in shoulder season and off-peak travel.

“The months of June, September and October are becoming popular, effectively widening the peak season, as reflected in lodge rates. So we’re seeing a longer tail on the shoulder seasons extending into April and May. There is awareness that these times provide a quieter experience and are less expensive.”

Booking lead times lengthen

In 2024, travellers booked their safaris an average of 19 weeks in advance in comparison to just six weeks in 2022. Chapman said this reflects “unprecedented demand”.

“When you have a relatively small inventory, the days of being able to have all your options available while looking, in the same year of travel, in peak seasons are swiftly coming to an end. This again ties into people’s willingness to start considering alternative areas they may otherwise have looked past or travelling outside the traditional peak seasons.”

The US remained Go2Africa’s leading source market for enquiries in 2024, followed by Canada, Australia and the UK. These top three markets accounted for 70% of all enquiries.

Trends expected in 2025

Go2Africa expects safari-goers to continue seeking experiential and impactful travel, favouring conservation-focused experiences, off-the-grid destinations and a fusion of adventure with high-end wellness and culinary offerings.

Artificial intelligence (AI) will continue to exert its influence on travel planning, added De Rijk-Uys.

“AI-powered tools are streamlining safari planning by enabling more personalised and efficient booking experiences, making inspiration-driven travel easier than ever.”

Growth in interest for multigenerational family safaris will be sustained, she said.

“This trend is expected to flourish as parents prioritise experiences for their children over material things.”