Kenya’s hospitality is expected to grow in 2018. This is according to the PricewaterhouseCoopers (PwC) report, ‘Hotels outlook: 2018-2022: South Africa – Nigeria – Mauritius – Kenya – Tanzania’.

The industry can expect an 8.8% increase in arrivals in 2018, building on the growth of late-2017, says PwC. “Going forward, assuming a period of relative stability, we expect tourism to Kenya to increase at a 6.9% compound annual growth rate, rising to 2.06 million in 2022.”

The country experienced a sharp drop in arrivals and hotel occupancy in September and October 2017 following the Supreme Court ruling that overturned the result of the August presidential election. However, arrivals rebounded in December and by the end of the year, the immediate impact of the court ruling was wearing off with strong growth in early 2018.

Providing an overview of the report in Johannesburg on July 5, Basheena Bhoola, Associate Director at PwC South Africa, said prior to this time there had been a period of stability and security in the country. However, when the election took place in August 2017, it created uncertainty in the market.

PwC noted that an increase in air access, an effort to boost tourism intra-continentally and efforts at improving infrastructure had all helped.

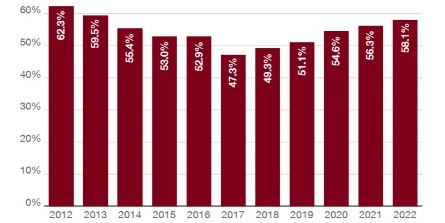

Occupancy Rates (%). Credit: PricewaterhouseCoopers LLP, Wilkofsky Gruen Associates.

Despite the instability, Kenya continued to win the race among rivals Nigeria and Tanzania for international hotel brand presence. Additionally, PwC noted the increase in development of new hotels and the refurbishment of existing properties as an indication of the confidence within the hotel industry in Kenya as a destination.

For example, both Sheraton and Best Western have undergone rebranding, with Sheraton taking over the Best Western in Nairobi and Best Western rebranding the Meridian Hotel as a Best Western Plus.

Additionally, the outlook looks positive for room rates. Total room revenue will expand by 8.1%, compounded annually, rising to $690 million in 2022 from $436 million in 2017.

Average Room Rates (US$). Credit: PricewaterhouseCoopers LLP, Wilkofsky Gruen Associates.

PwC noted particularly an increase in demand for facilities suitable for business travellers, with Bernice Kimacia, a PwC Assurance Partner saying: “Increasing business traveller demand is driven by Nairobi’s position as an East Africa commercial hub and multiplier effect of devolved government including county economic development. Several new properties under development in Nairobi and some upcountry towns indicate a targeted effort to attract increasing numbers of business travellers who may require specific services like conferencing facilities.”

In fact, Kimacia predicts that 2018 will be a business-traveller-focused year, with tourism taking a back seat: “Economic growth, ongoing investment in transport infrastructure and oil production is likely to spur more economic activity across the country.”

Over the next two years, PwC says the introduction of a number of strong international brands, including Radisson Blu, Pullman and Mövenpick, will mean 1 800 new rooms. Projected growth is expected to continue with a 14% increase in hotel capacity over the next five years.

“The combination of new hotels, more flights to Kenya, stronger economic growth, lower inflation and, most importantly, greater security, should contribute to growth in guest nights. We project guest nights to rise at a 6.9% compound annual rate during the next five years,” says PwC.

Investment in the hospitality industry remains positive. However, Kimacia believes investment in Kenya should be done with caution: “This is not to downplay Kenya’s advantages but instead to convey realism. With a competitive and differentiated value proposition, hotels can prosper in the short- and medium-term. But a one-size-fits-all approach is not likely to work in Kenya.”