As confidence in outbound travel from China surges, so too does the urgency to cement practical measures needed for southern and East Africa to effectively compete with long-haul destinations and reach ambitious tourist arrival targets from the Asian giant.

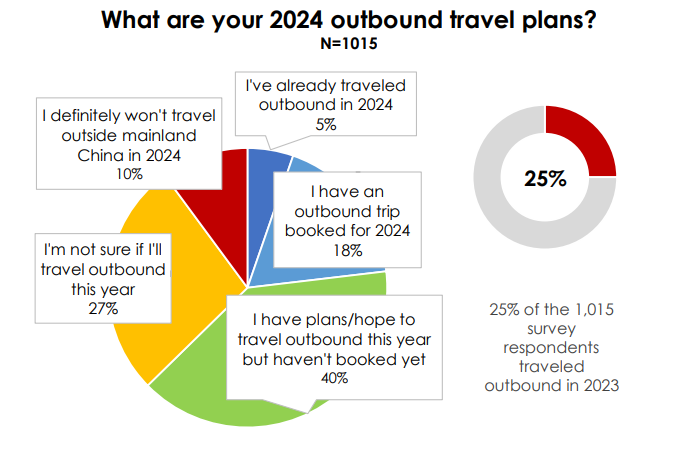

In April, travel analytics firm Dragon Trail International released its Chinese Traveller Sentiment Report, which found a significant positive shift in Chinese traveller confidence since April last year. Of the more than 1 000 respondents from mainland China, 63% voiced plans to travel or had already travelled outbound in 2024, compared with 41% in 2023.

“Chinese consumers have more plans to travel abroad and to travel further. Pandemic-era caution has given way to a new sense of adventure, as travellers seek out relaxation and exotic experiences beyond the borders of mainland China. In the eyes of Chinese travellers, the world now seems like a safer place than it did before, with safety ratings continuing to improve for nearly all destinations in our survey,” the report stated.

Golden opportunity

In 2024, the Chinese outbound market is expected to reach around 80% of pre-COVID levels, amounting to 130 million trips. Southern and East Africa tick off many of the attributes that Chinese travellers most desire in a destination, which, according to Dragon Trail’s survey, include exoticism, diversity of attractions and cultures, and value for money.

In comparison to other long-haul destinations, the region falls short in key criteria such as ease of access (selected by 30% of the survey’s respondents), safety and stability (25.5% of respondents) and convenience of visa policies (24.3%).

“Current barriers include perceptions of poor visitor safety — the Chinese are very safety-conscious and will avoid perceptional risks. Other barriers are the limited flight options and very long flight times, along with bureaucratic visa requirements,” said tourism consultant and The Journey MD, Mike Fabricius.

These obstacles stand in the way of ambitious targets set by countries such as South Africa, which aims to attract one million annual arrivals from China by 2030. In 2023, the country welcomed just over 37 000 Chinese visitors, amounting to under 2% of all arrivals from overseas.

“The current Chinese market to South Africa is small and probably comprises a large proportion of non-discretionary travellers who come for business and visiting friends and relatives. At this stage it is probably for the marketing authorities and private operators to decide if China presents a low-hanging opportunity relative to other emerging markets in Eastern Europe, the Middle East, Africa and other areas,” said Fabricius.

He advised that South Africa had to be realistic and strategic about the extent of the opportunity presented by the re-emergence of the Chinese market, as the bulk of long-haul travellers preferred urban destinations in Europe and the US.

“In terms of approach, South Africa should be very targeted and aim for specific market segments. These could be seasoned and well-travelled smaller group travellers who have experienced the Western world’s main destinations and are looking for more adventurous opportunities,” said Fabricius, also touting the potential to appeal to independent travellers and special-interest niche segments in adventure sports and eco-tourism.

“This is a complex market that requires excellent knowledge of travel behaviour of the various target market segments, including the times of year in which they travel, trip length, intermediaries used to arrange travels, online information and booking channels used and food and cultural preferences,” said Fabricius.

“If the issues mentioned above are addressed, I’m confident that South African operators are well equipped to respond to market demands with creative packaging and service provision. The situation may of course change with specific interventions such as better flight access, visa liberalisation and a proactive and incentivised push by the Chinese government to encourage travel to South Africa,” Fabricius added.

Speaking at WTM Africa in April, Marcus Lee, CEO of China Travel Online, stressed the need for destinations to get ‘China-ready’ for the country’s peak outbound travel season over the summer holidays in July and August.

“The Chinese tourism market is primed for a comeback, but destinations need to be proactive in their approach. Africa is not homogeneous – each destination and region needs to showcase its unique selling points to stand out. Those who get it right will reap the rewards of this valuable source of visitors,” said Lee.

Catering for unique booking preferences

Dragon Trail’s research found that Chinese online booking platforms such as Ctrip and Qunar are the most common channels for outbound travel itineraries and services, selected by 60% of survey respondents.

Operators looking to attract Chinese tourists also need to be aware of the evolving role of social media in China’s travel market. The survey shows that 38% of respondents opt to book through popular Chinese social platforms such as WeChat or Xiaohongshu, backing up Lee’s observations on the vastly different digital landscape compared with the West.

“We don’t have access to Google, YouTube, or other platforms that are commonly used. Reaching the Chinese market requires a dedicated China-focused digital strategy.”

In April, the City of Cape Town announced that it would launch a social media marketing campaign targeting various cities across China via WeChat, which is currently used by over 1.3 billion people – about 80% of the country’s population.

Kenya has also utilised WeChat and video-sharing platform TikTok as key platforms for its destination marketing efforts in China. In 2023, the Asian powerhouse was Kenya’s eighth-largest tourism source market, accounting for over 52 800 arrivals.